Is Mortgage Refinancing Right for You? Here’s How to Know — and What to Do Next

Refinancing your mortgage isn’t just about getting a lower rate—it’s about making your loan work better for your current life. Whether you’re chasing lower payments, faster payoff, or cash in hand, the path you take depends on your purpose. Let’s break it down.

🎯 Goal #1: Lower Your Monthly Payment

If you're mainly looking to save month-to-month, focus on these:

-

Interest rate drop: If today's rates are even 0.5%–1% lower than when you bought your home, refinancing could save you thousands over time.

-

Stretch your loan term: Going from a 15-year to a 30-year term reduces monthly payments (but increases total interest).

-

Drop PMI: If you've built 20% equity, refinancing might eliminate private mortgage insurance—instantly lowering your payment.

Heads-up: Extending your loan resets the clock, so weigh immediate savings against the long-term cost.

🏃♀️ Goal #2: Pay Off Your Loan Faster

Want to own your home outright sooner?

-

Refinance to a shorter term: A 15- or 20-year mortgage often comes with a better rate and saves you a ton in interest.

-

Make extra payments without refinancing: Some lenders allow principal-only payments—ask before you refi.

Quick tip: Run the numbers. The monthly jump from a 30- to 15-year term can be significant.

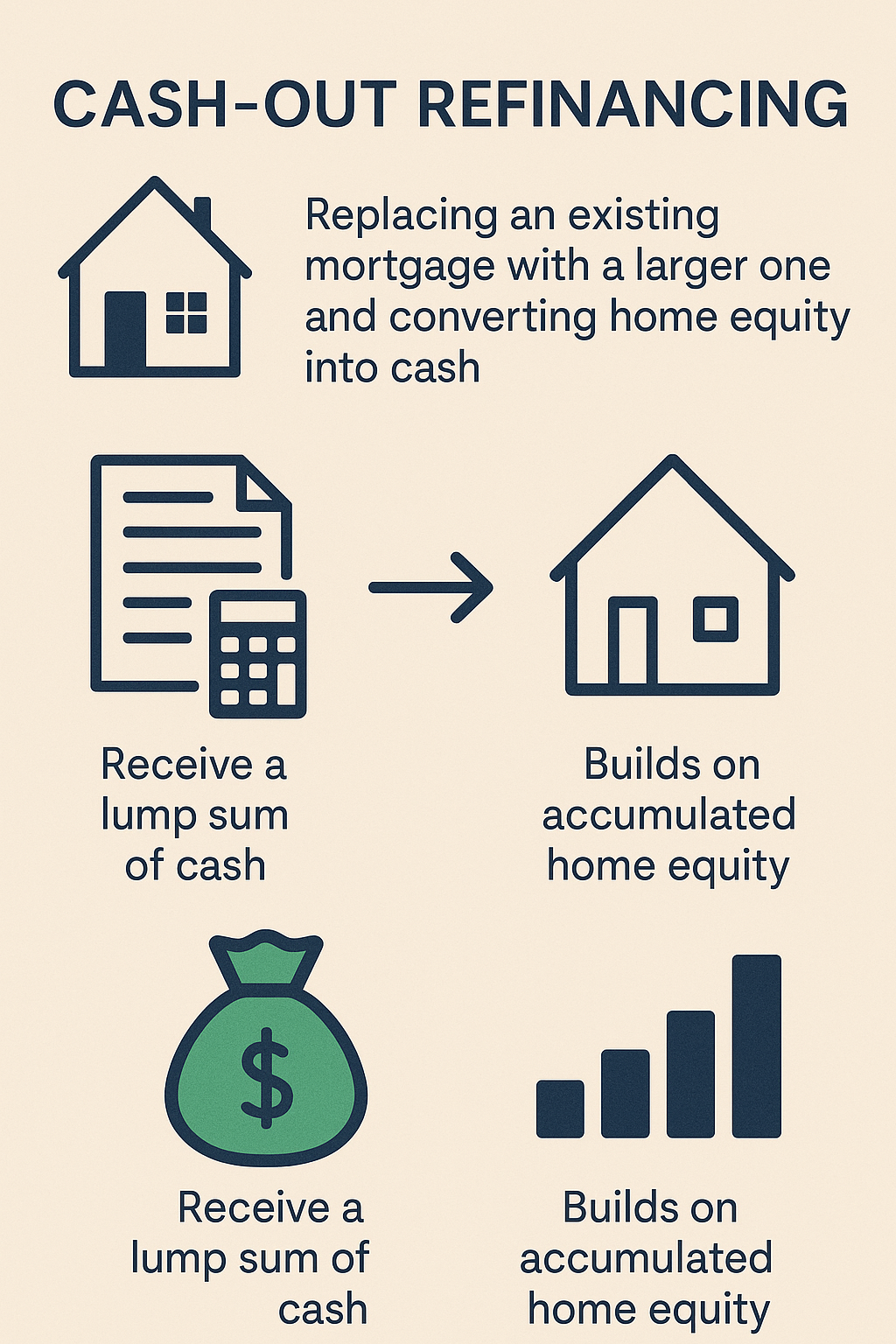

💰 Goal #3: Access Equity with a Cash-Out Refinance

Home values are up—and that equity could be working for you.

-

What it is: A cash-out refi replaces your existing mortgage with a larger one, and you pocket the difference.

-

Use cases: Home improvements, debt consolidation, college tuition, or even a down payment on a second property.

-

Pros: Lower interest rates than credit cards or personal loans.

-

Cons: You’re increasing your mortgage balance, and possibly your monthly payment.

Make sure you’re not overextending. A home isn’t an ATM—use the equity strategically.

🧾 What You’ll Need to Refinance

Regardless of your goal, expect to provide:

-

Proof of income (W-2s, pay stubs)

-

Asset and debt information

-

Homeowner’s insurance and property tax info

-

Possibly a new home appraisal

Your credit score and debt-to-income ratio are key factors. Lenders want to see stability and enough equity in the home.

💡 Other Refinancing Scenarios to Consider

-

Switching from an ARM to a fixed-rate: Great when rates are rising.

-

Divorce or co-borrower changes: Use refinancing to remove someone from the mortgage.

-

VA, FHA, or USDA streamline options: These government-backed programs can simplify the process if you qualify.

🧮 Don’t Forget the Math: Break-Even Point

Before you refinance, ask: How long will it take to recoup the costs?

For example, if you pay $4,000 in closing costs and save $200/month, your break-even point is 20 months. If you’re not staying in the home that long, refinancing might not be worth it.

Bottom Line

Refinancing isn’t a one-size-fits-all move. The right approach depends on where you are in life—and where you’re going. Whether you want lower payments, faster ownership, or access to your equity, take the time to understand the trade-offs.

Want help comparing options or running your break-even point? Reach out and let’s find the right fit for your financial future.

Wanna know your monthly mortgage? Try our free mortage calculator

Categories

Recent Posts